What to do?

in a time of SPAC's, Subreddits and bubble talk

Economists, TV Anchors, investors, analysts and, ahem, bloggers all have their own view and expectation on what they think is likely to occur. Each of them have a compelling case supported by data, graphs and historical reports.

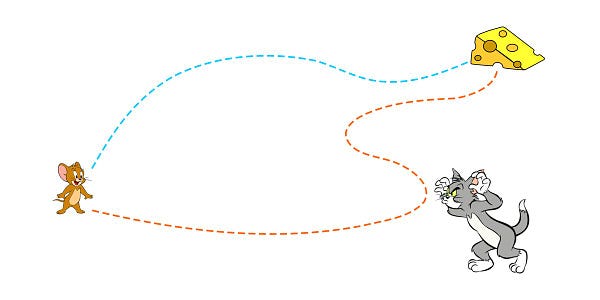

The problem is. They contradict each other; we are about to have inflation not seen in the last decade, others argue the opposite. What about all the bubble talk? Are we at the end of the bubble-ish market, or is it just starting? Should we double down on tech stocks. What about commodities?

Following the business channels for an hour will leave you more confused than informed…So, what can we do?

First, filter out the noise and try to get rid of your fear to miss out, FOMO, on the next Tesla.

Followed by starting to be comfortable with doing nothing and waiting, which is a difficult thing to do. I struggle with it. I fear making mistakes of omission. Not pulling the trigger and missing out on the next best thing, and I missed many, many investment opportunities that turned into 10 baggers.

That still leaves my question unanswered. What to do?

Let’s start of what we know for sure:

Markets are frothy, based on historical measures. However they can still easily double from here, or crash 30%.

There is still lot’s of uncertainty regarding resuming normal life as pre Covid-19. Vaccine roll out is slow and won’t be completed by the end of the summer, best case scenario. This means that countries will remain in some form of lockdown until then.

Governments and Central banks will continue to support the economy. Rates will remain low, with funding for struggling SME’s and unemployed.

Retail, travel, and entertainment venues will remain mostly closed.

In summary, we have an uncertain future with potential extreme outcomes.

When things get messy and unclear, it’s time to get back to basics. Therefore, I will start with some spring cleaning:

Clear out small and unnecessary positions:

Option trades

Low and medium conviction equity positions

Keep portfolio turnover to a minimum:

No trades, only a handful of put options as a hedge

Focus on quality:

Low debt, high return with competitive edge, investments that can weather any storm.

When everything has been cleaned and organized, I can start to read, study and build up my watchlist of high quality companies. When I find one that is reasonably priced and it checks all the boxes. Great, another addition to the portfolio.

Doesn't sound as exciting as looking for the next electric car company, it sounds even a bit boring. But maybe boring is what I need in a time of SPAC’s and WSB’s subreddits pumping stocks to the moon and beyond.

To close off:

“Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

In any economic climate, how do we build economic security, foster love, and find joy? How do we get rich?

Slowly.”

Quote from Charlie Munger:

"Another thing you have to do, of course, is to have a lot of assiduity. I like that word because it means: sit down on your ass until you do it."

NICK TRAIN: “The principles underlying [Buffett’s ideas] remain relevant. The two dominant and differentiating aspects of what we’ve done – both of which are absolutely, unapologetically copied directly from Buffett’s advice – have been number one: run concentrated portfolios. I think you look at everything we do, that’s the first thing that strikes people. It’s a concentrated portfolio. The other Buffett derived behavior is to discipline ourselves to try and transact as rarely as we possibly can, to keep portfolio turnover as low as we can. That is emotionally difficult, psychologically difficult, intellectually difficult, and sometimes plain wrong. It can be plain wrong not to do anything. But, in our experience observing other successful practitioners, it does seem to us that you at least tilt in your favor the possibilities of doing well if you know what you’re doing and you’re prepared to ride the emotion. Because it is an emotional arena.” YouTube - January 18, 2021 source: https://santangelsreview.com/ newsletter

Path dependence: